90 Days of Trading, Day 1: What is swing trading and how does it differ from day trading?

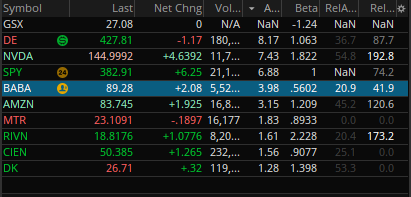

90 days of trading starts today, post 1/90. Please help us get the word out by sharing! Swing trading is a trading strategy that involves holding positions for a period of a few days to several weeks, in an attempt to profit from price swings in financial markets. The goal of swing trading is to identify the beginning and end of a trend and capture gains from the price swings that follow. Swing trading is different from day trading, which involves holding positions for a very short period of time, usually just for a few hours or even just a few minutes. Day traders aim to profit from the small price fluctuations that occur throughout the day, and they close out their positions at the end of each trading day. One key difference between swing trading and day trading is the holding period. Swing traders tend to hold positions for a longer period of time, while day traders hold positions for a very short period. This means that swing traders may be more exposed to the risks of holding positions overnight or over the weekend, while day traders do not face this risk. Another difference between the two strategies is the level of activity and the number of trades made. Day traders tend to make many trades in a single day, while swing traders may make only a few trades over the course of a week or a month. In general, swing trading may be suitable for traders who have a medium-term outlook and are comfortable with holding positions for a longer period of time. Day trading, on the other hand, may be more suitable for traders who have a shorter-term outlook and are comfortable with the fast-paced nature of the markets.